average cost to install solar panels on roof sets the stage for a deep dive into the financial aspects of switching to solar energy. As homeowners increasingly seek sustainable energy solutions, understanding installation costs becomes crucial. Here, we’ll explore what you can expect to pay when outfitting your roof with solar panels, the various factors that play into those costs, and how financing options and government incentives can help lighten the financial load.

From the type of panels you choose to the size of your roof, multiple elements impact the overall cost. Additional expenses such as permits and inspections can also add up, making it essential to have a clear picture before you begin. We’ll break down these costs and help guide you to make an informed decision about your solar panel investment.

Overview of Solar Panel Installation Costs

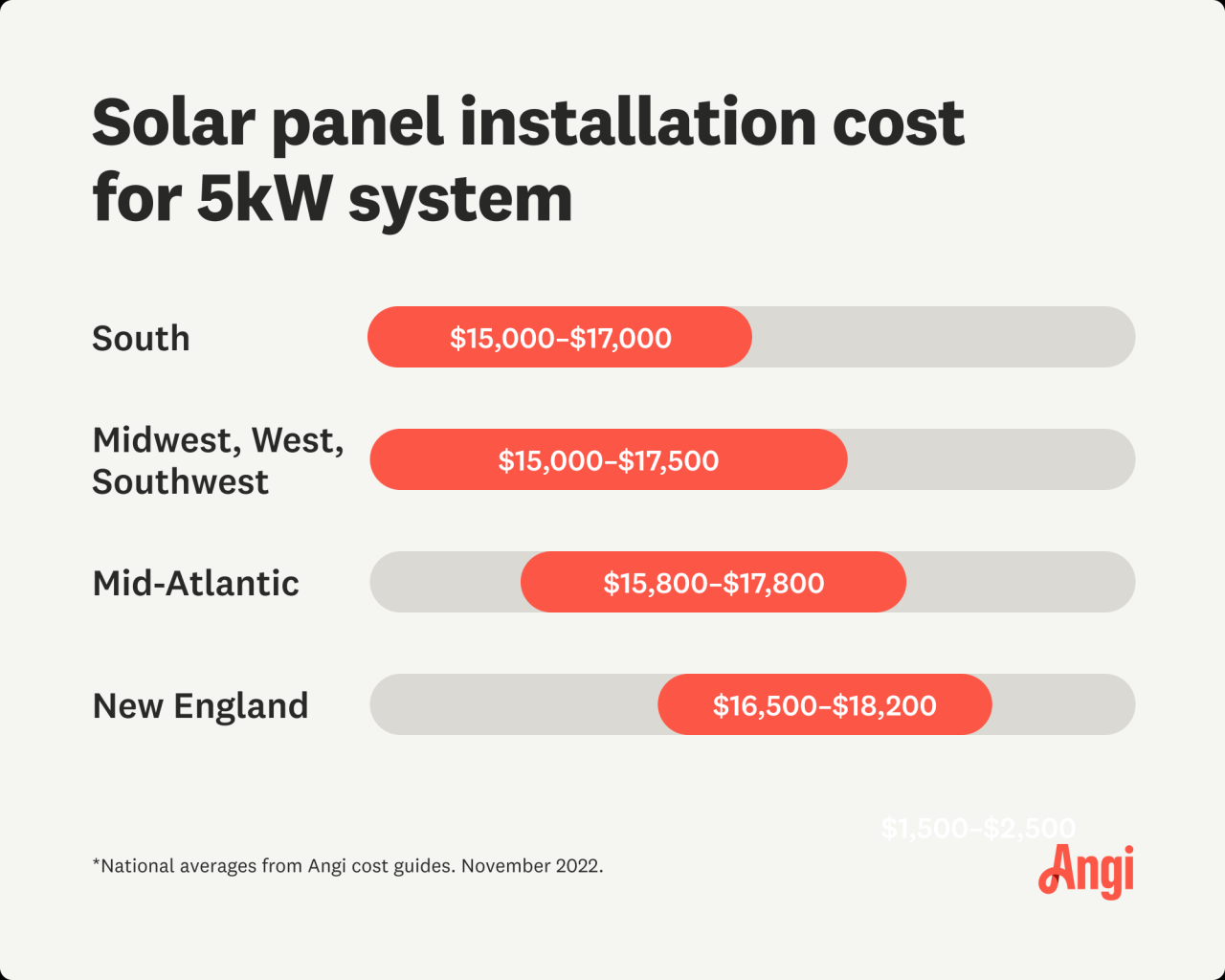

Installing solar panels on your roof can be a significant investment, and understanding the associated costs is crucial for homeowners considering this option. On average, the cost of installing solar panels for residential roofs typically ranges from $15,000 to $30,000 before any tax credits or incentives. This wide range reflects various factors that influence the total price, including the type of solar panels, the complexity of the installation, and any additional expenses that may arise.

The overall cost of solar panel installation is influenced by several key factors. The type of solar panel chosen, such as monocrystalline, polycrystalline, or thin-film, significantly affects the price. Furthermore, the size and slope of your roof can dictate how many panels are needed and how difficult the installation may be. Larger roofs may require more panels, increasing the total cost. Other factors include local labor rates, potential structural modifications needed for your roof, and the specific installation company’s pricing.

Potential Additional Costs

When planning for solar panel installation, it is essential to consider potential additional costs that can arise beyond the initial purchase and installation fees. These costs can include permits, inspections, and other necessary adjustments. Understanding these fees can help you budget more accurately.

- Permitting Fees: Many municipalities require permits for solar panel installations, which can range from $100 to $1,000, depending on local regulations.

- Inspection Fees: After installation, a professional inspection may be needed to ensure compliance with local codes, typically costing between $100 and $300.

- Electrical Upgrades: If your home’s electrical system requires upgrades to handle the new solar system, this could add another $1,000 to $3,000 to your overall expenses.

- Roof Repairs: If your roof is in poor condition, you might need repairs that could range from a few hundred to several thousand dollars before installation can begin.

The total cost of solar panel installation can ultimately vary widely, influenced by both direct installation costs and additional expenses related to permits, inspections, and upgrades.

Financing Options for Solar Panel Installation: Average Cost To Install Solar Panels On Roof

Installing solar panels is an investment that can lead to long-term savings on energy costs. However, the upfront costs can be daunting. Fortunately, there are various financing options available that can help make this renewable energy solution more accessible for homeowners. By understanding the different financing methods, state and federal incentives, and tax credits, you can significantly reduce your installation costs and find the best fit for your financial situation.

Types of Financing Methods, Average cost to install solar panels on roof

When considering solar panel installation, it’s essential to explore the various financing methods that can ease the financial burden. The most common options include:

- Solar Loans: These are personal loans specifically designed for financing solar panel installations. They allow homeowners to pay for the system upfront and repay the loan over time, typically with fixed interest rates. This option can lead to immediate savings on energy costs.

- Solar Leases: Under a solar lease, a homeowner pays a fixed monthly amount to use the solar system installed on their property, without owning it outright. This option often requires little to no upfront payment, making it easier for those on a tight budget.

- Power Purchase Agreements (PPAs): Similar to leases, PPAs allow homeowners to pay for the energy produced by the solar panels rather than the panels themselves. The rate is usually lower than the local utility’s rates, offering savings on monthly energy bills.

- Cash Purchase: If financially feasible, paying for a solar system in cash allows homeowners to avoid financing costs and take full ownership, leading to greater long-term savings.

State and Federal Incentives

Numerous incentives are available at both the state and federal levels that can significantly reduce the cost of solar panel installation. Understanding these incentives can help you maximize your savings.

- Federal Solar Tax Credit: The federal government offers a tax credit, known as the Investment Tax Credit (ITC), which allows homeowners to deduct a percentage of the installation cost from their federal taxes. As of 2023, this credit is set at 30%, providing substantial savings.

- State Incentives: Many states offer additional tax credits, rebates, or grants to encourage solar adoption. For instance, California has the California Solar Initiative (CSI) program, which provides cash rebates for solar installations.

- Property Tax Exemptions: Some states allow homeowners to exclude the added value of the solar system from property tax assessments, ensuring that your home doesn’t incur higher taxes after installation.

- Renewable Energy Certificates (RECs): Homeowners can also earn RECs for generating renewable energy, which can be sold to utilities or companies that need to meet renewable energy standards.

Comparing Financing Options

Finding the best financing deal for your solar panel installation requires careful comparison of different options. Here are some tips to consider:

- Interest Rates: Shop around for the lowest interest rates on loans and leases. Even a small difference can lead to significant savings over time.

- Loan Terms: Examine the length of the loan or lease agreements. Shorter terms may have higher monthly payments but less interest paid overall.

- Monthly Payments vs. Savings: Calculate potential savings on your energy bill and compare it against the monthly payments of your financing option. Aim for options where savings exceed costs.

- Incentive Eligibility: Ensure that the financing option you choose allows you to take full advantage of available incentives, as this can greatly affect your overall cost.

Cost Comparisons for Different Solar Technologies

As the solar energy market evolves, various technologies have emerged, each with distinct costs and efficiencies. This section delves into the financial implications of traditional solar panels compared to newer innovations like solar shingles. Understanding these differences is vital for homeowners looking to make informed decisions about solar installations.

When considering the cost of solar technologies, traditional solar panels typically consist of crystalline silicon cells, which have been the standard for many years. Conversely, solar shingles, which are a newer technology, integrate solar cells into roof shingles, providing a dual function of roofing and energy generation. The costs associated with these technologies can vary significantly based on their efficiency, installation requirements, and aesthetic appeal.

Cost and Efficiency Comparison of Solar Technologies

The financial investment for solar technologies should be examined alongside their efficiency ratings to provide a comprehensive overview. Traditional solar panels generally have a higher efficiency rate than solar shingles, but the latter offers benefits in terms of aesthetics and potentially lower installation costs.

To visualize the distinctions in cost and efficiency, the table below illustrates the average costs, efficiency ratings, and the expected long-term savings associated with each product type:

| Solar Technology | Average Cost per Watt | Efficiency Rating (%) | Estimated Long-Term Savings (25 years) |

|---|---|---|---|

| Traditional Solar Panels | $2.50 – $3.50 | 15 – 22 | $20,000 – $30,000 |

| Solar Shingles | $3.50 – $5.00 | 14 – 20 | $15,000 – $25,000 |

In this table, the cost per watt reflects the initial investment, while the efficiency rating indicates how effectively the technology converts sunlight into electricity. The estimated long-term savings represent the financial benefits homeowners can expect over 25 years, factoring in utility bill reductions and potential government incentives.

According to industry reports, investing in traditional solar panels often yields higher efficiency and savings in the long run despite their higher upfront costs. In contrast, solar shingles, while being visually appealing and functionally dual-purpose, may have lower efficiency and savings potential. However, they could save on roofing costs if you are replacing your roof simultaneously.

“A careful analysis of both costs and long-term benefits is crucial when choosing a solar technology.”

This highlights the importance of evaluating both immediate costs and future savings to make the best solar investment decision.

Understanding the Return on Investment (ROI)

Investing in solar panel installation is not just about the immediate costs; it’s also about understanding the long-term financial benefits. Return on Investment (ROI) is a crucial metric that helps homeowners gauge how much they can expect to earn back from their solar investments over time. By understanding the ROI, homeowners can make informed decisions about whether solar energy is the right choice for them.

Calculating the ROI for solar panel installation involves several key factors, including initial costs, savings on energy bills, and available incentives. The formula for ROI can be expressed as follows:

ROI = (Net Profit / Total Investment) x 100

In this case, net profit is the total savings from reduced energy bills and any applicable tax credits or rebates received after deducting the installation costs. When assessing the potential ROI, it’s essential to take into account the lifespan of the solar panels, typically around 25 years, and the expected reduction in monthly energy expenses.

Common Misconceptions About the Payback Period

There are several common misconceptions regarding the payback period for solar panel investments. Many people believe that the payback period is always lengthy, but in reality, it varies based on several factors such as location, energy consumption, and available incentives. Understanding these nuances is important for an accurate assessment of potential savings.

1. Immediate Savings: Many homeowners expect immediate financial returns. However, while energy savings start accruing right away, the full payback period can take several years depending on the installation costs and local energy rates.

2. Incentives and Rebates: Some homeowners overlook the significance of federal, state, and local incentives which can significantly shorten the payback period. For instance, federal tax credits can cover a substantial percentage of installation costs.

3. Energy Rate Fluctuations: Many assume that energy rates will remain stable. However, rising electricity prices can lead to better savings in the long run, thus reducing the payback period.

Case Studies of Successful Solar Panel Installations

Examining real-world examples of successful solar panel installations provides valuable insights into the potential ROI and financial outcomes of going solar. Here are a couple of case studies showcasing the benefits of solar energy investments:

– Case Study 1: Residential Installation in California: A homeowner invested $20,000 in a solar panel system. With a federal tax credit of 26%, the net cost dropped to $14,800. By reducing their monthly electric bill from $200 to $25, they saved $175 monthly. Over 25 years, this resulted in total savings of approximately $52,500, yielding an ROI of 254%.

– Case Study 2: Commercial Installation in Texas: A small business installed solar panels costing $50,000, receiving a $15,000 rebate from the state. After accounting for reduced operating costs and tax incentives, the business saw their payback period shorten to just 4 years. Their annual savings of $10,000 made for a remarkable ROI of 40% after 10 years.

These examples illustrate that, while initial costs can be daunting, the long-term financial benefits often outweigh these expenses, leading to substantial savings and a favorable ROI.